Working from home has been an experiment and experience that has tested many businesses, but has also shown the path to a more flexible work arrangement. It has also made the idea of mobile office work more viable. The same tools that let people work from home will also support running a mobile office.

You might not be thinking of giving up your physical office, but it’s still a good idea to be prepared to manage office work remotely. If something should prevent you from going to the office, you won’t have to give up a full day’s work. You can keep up with the help of office management software tools.

Flexibility is always something you want to build into your work systems. Even if you don’t plan to be a mobile office worker on a frequent basis, you’ll be glad you have that option if you ever do require it.

And if you want to transition into running a mobile tax office, that is perfectly possible with the right set of tools.

Advantages of Mobile Office Work

The shift toward the acceptance of remote work has partly been driven by advances in technology. With so much work being performed and recorded within digital spaces, the need for physical outputs has declined. If your output is digital, then you can produce it anyplace given the right tools.

The Internet, laptops, mobile apps, and cloud services all help to make remote work a viable choice that doesn’t harm productivity. You might even see a boost to your productivity! Reducing stress can lead to better work outcomes, after all.

Let’s take a look at some benefits of running a mobile office:

- Stress reduction – As mentioned above, reducing stress can bring about better worker productivity. An office environment may prove stressful to certain people. Allowing them to work in a less stressful environment can improve motivation and enhance work quality.

- Less time commuting – One of the biggest contributors to stress is the daily commute that so many professionals face. Commuting eats up time and energy that could be better spent on other things. Driving can be equally stressful and time-consuming. Mobile work takes away the need to commute to the office every day.

- Flexibility – For the remote worker, one’s office can be any place where you can use your laptop. That could be a room in your house, a cafe, a library, or even your car. You can work while traveling or meeting clients outside the office. Furthermore, you are not limited to normal office hours, but can adjust your work schedule as necessary. You can achieve better time management.

- Motivation – The flexibility of mobile and work-from-home arrangements can be an excellent fit for certain types of professionals. The sense of empowerment and freedom this gives someone can be a powerful contributor to job satisfaction and employee motivation.

Does It Make Sense for Your Tax Office?

Tax preparation is a professional service that revolves around client meetings and tax form processing. That makes it a perfect fit for a mobile business setup. Especially since tax form processing can be accomplished with specialized software using your laptop. Some applications even allow you to do tax return preparation on your phone or other mobile device.

As for client meetings, they don’t necessarily require face-to-face communications anymore. People have gotten accustomed to attending meetings over Zoom, Skype, and other online meeting platforms. If your clients are agreeable to that scenario, you can conduct meetings with them online over a secure and private connection.

Would you benefit from running a tax office on the go? Let’s look at some key factors.

- Location – Does your tax office benefit from a strategic location? You might have an office that is situated in a commercial office block or industrial park. In which case, clients may greatly value the convenience and accessibility of your tax office. That is one possible reason why you might favor a physical office setup over a mobile office.

- Travel time – Take note of how much time it takes you to drive or commute from your home to the office. Also take note of how far you have to go to meet with clients. Even if you have a home office, you might need to leave to attend meetings in the city center. The ability to do mobile work can be a real boon to your time management.

- Technology – You will need to make use of various software tools if you want to work remotely as a tax preparer. These tools include online meeting software, productivity tools such as spreadsheets, tax preparation software, and office management software. Are you using such software tools? Are you willing to learn them and use them?

- Broadband speed – Online workers are going to need regular and consistent access to high broadband speeds. Most professionals would have no problem with this requirement, especially folks who operate in a major metropolitan area. But not all tax offices are located in such areas. If you cannot rely on high-speed Internet access, you might not find a mobile office setup very workable.

- Self-motivation – Would a remote work setup be conducive to your self-motivation? If you find the idea exciting and liberating, you might greatly benefit from a mobile setup. It could mean a boost to your productivity and your overall job satisfaction. That alone could justify a mobile office experiment, even if other factors are not so aligned.

The Power of Autonomy: Its Positive Effect on Performance

An autonomous, mobile setup has proven to be a great method of improving employee motivation and performance. As telecommuting has become more widely accepted in the business world, researchers have been able to gather more data on how it stacks up compared to working from the office.

One such study has concluded that telecommuting has a positive impact on performance. “The Good, the Bad, and the Unknown About Telecommuting” is a Penn State study by Dr. Ravi S. Gajendran and Dr. David A. Harrison. It examines the positive and negative consequences of working remotely.

The researchers found that telecommuting has “small but favorable effects on perceived autonomy, work– family conflict, job satisfaction, performance, turnover intent, and stress.” To emphasize the performance aspect, the study showed that doing remote work was associated with more positive performance ratings by supervisors.

What Do You Need to Run a Mobile Office?

Let’s assume that you’ve decided to go ahead with a mobile office setup. How do you make it happen?

First of all, you are going to need a work laptop. Ideally, a machine dedicated to professional tasks—keep it free of personal stuff for the most part. (You might want to allow for some entertainment options on this laptop, as that can improve motivation and reduce stress, but don’t go overboard.)

You’ll need a good working environment, unless you’re the type of person who can achieve a laser focus on tasks no matter what. Some remote workers opt for a coffee shop, but there are other possible alternatives. Look for something that works for you. Many places offer access.

You’ll definitely need a fast Internet connection. Broadband Wi-Fi, if you can access such a thing. You can also use a mobile Internet connection over 4G or 5G.

Those are the basic requirements. Then you will need software systems to make this a workable setup for the long term.

Software for Your Mobile Tax Office

Whether or not you’re doing remote work, you can enhance productivity with the right software systems. A tax office will want dependable tax preparation software and office management software. That will help you complete tasks more efficiently while experiencing less effort and strain.

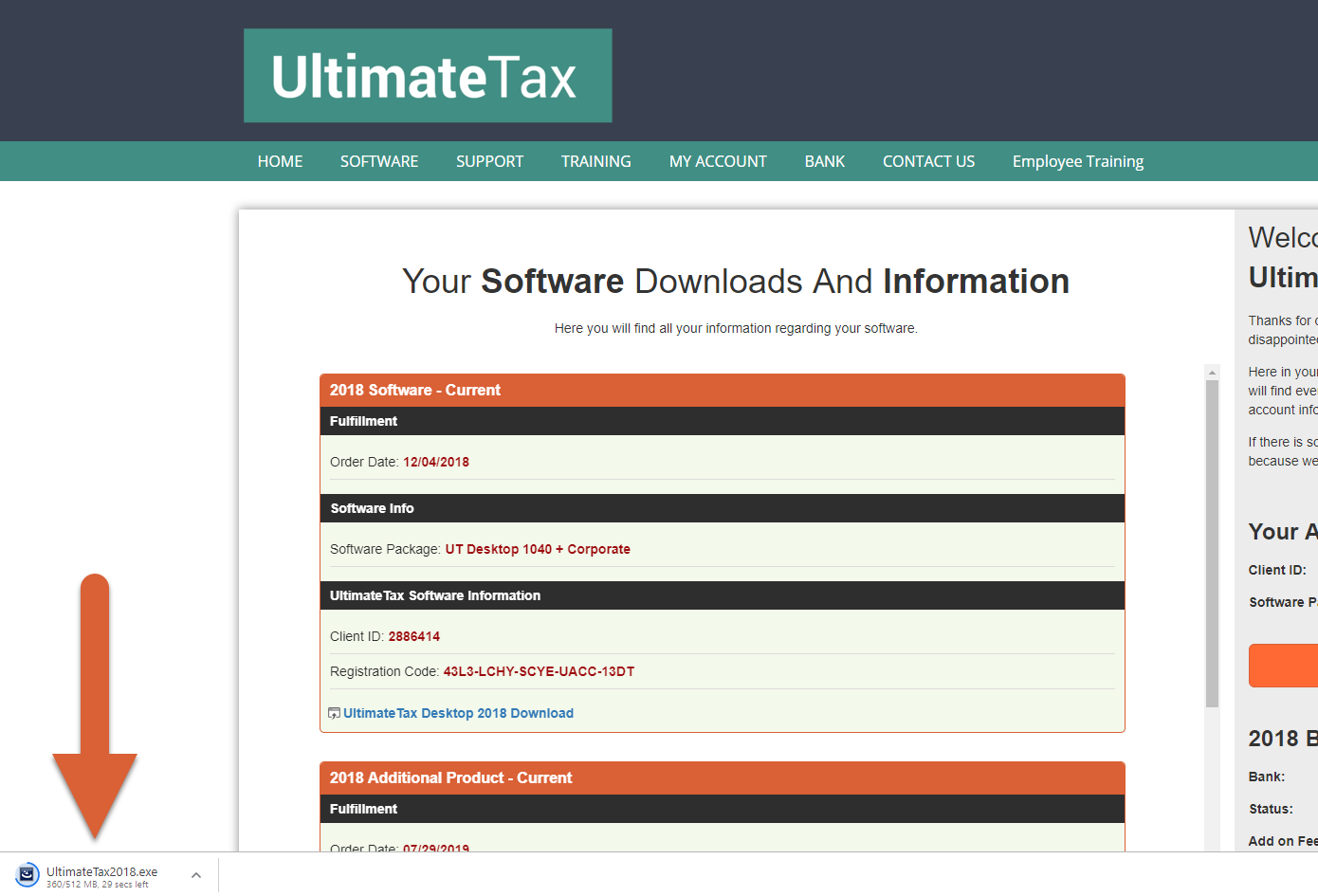

For your tax preparation software, check out UltimateTax, a robust and affordable application. UltimateTax speeds up business and income tax return processing and filing. Using it will help you achieve impressive and accurate results to the satisfaction of your customers. You’ll see an efficiency increase that will make it possible to take on more projects—and earn more revenue.

For office management software, take a look at ProClient. Created by the same company behind UltimateTax, ProClient is designed by tax professionals for tax professionals.

ProClient provides a comprehensive suite of software tools to simplify the many demands of managing a tax preparation business. A tax preparer needs to stay on top of appointment scheduling, document management, team management, CRM, communications, and invoicing and payments.

As a ProClient subscriber, you’ll get an easy-to-use Calendar app that simplifies all your appointment scheduling tasks. It can even deal with walk-in appointments. Plus it can link to your Outlook or Google Calendar account, which adds a lot of convenience.

ProClient lets you easily set up secure Client Portals. Customers can use these portals to send you documents electronically. You can organize and track these documents through ProClient. The documents are kept in cloud storage, providing you with backup copies.

ProClient can also help you with team management, CRM, messaging, and invoicing and payments.